Among love-seekers, some appear to have very specific romance criteria in mind. Who could forget farmersonly.com? If you’re not in the dating app demographic, you could be forgiven for missing that a short-lived service splashed into the digital match-making game back in February 2024 — one with personal finances elevated to levels typically reserved for geography, religion, or relative appreciation of dogs.

Score, which launched with a website and phone app, only allowed users with credit scores of 675 or higher. The idea was straightforward: You should pay attention to financial health before venturing into relationships, which Score’s owners named as the whole point. According to several online sources, the fintech company Neon Money Club built Score as something like a marketing tool, an attention-getter and ostensible conversation-starter. Initially set for a 90-day run, Score extended into a summer fling before closing in August of this year.

Like you could guess, the service received healthy doses both of criticism and praise. Some relationship gurus praised the foregrounding of finances as a measure of transparency and compatibility, while some prospective users seemed miffed at Neon Money Club’s use of a love-longing to bait users into its main offerings.

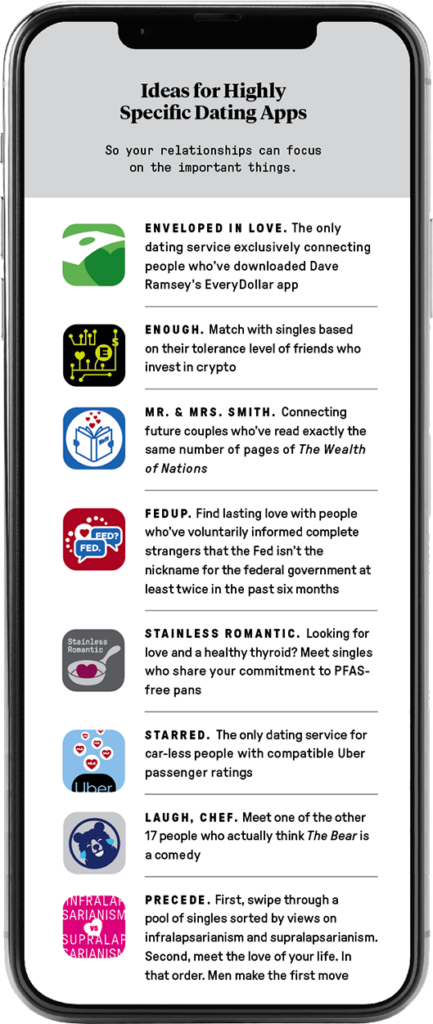

Whatever the merits of credit-based romance, Score recalled the important lesson of farmersonly.com. The people want more ridiculously specific dating services. And with data from Pew Research Center suggesting last year that three out of 10 Americans use or have used a “dating site or app,” the opportunities are vast.