The holiday season is a canary in the economic coal mine.

Black Friday kicks off the largest shopping season of the year, pushing the negative, red retailer financials into the positive, black territory. That phenomenon matters particularly this year, not only for retailers, but for all of us. Because consumer spending is one of the primary indicators of economic health of our economy, that means shoppers today, and during the next few weeks, will give us a diagnosis of the American economy — including whether we’re in, headed for, or avoiding the oft-discussed recession.

Consumer spending has been increasing over the last few months, but some expect that to slow down. Shoppers are saving less, spending more, and driving up debt. How long can that last? The Wall Street Journal noted last week that “consumer spending is on borrowed time,” which will run out in “nine to 12 months.”

Now the question everyone is asking is whether high prices will slow down sales this holiday season. Although some analysts believe this will happen, they expect shoppers to spend the same amount of money as last year, but on fewer goods: “Shoppers plan to spend around $1,455 over the season, in line with last year, according to a September survey of nearly 5,000 shoppers from Deloitte. Shoppers plan to purchase around nine gifts, down from 16 last year, said the survey.”

But to answer that question definitively, business leaders and economists are proceeding with caution.

Spending your savings

It matters how we spend. But what do we mean by spending? When economists want to get a sense of consumer spending, they also consider consumer savings. Savings, of course, are affected by interest rates: A low interest rate incentivizes people to spend more, since banks offer a lower yield for their savings. A low interest rate also incentivizes people to spend more because money is cheap — and a loan on, say, a car or house is easier to swallow.

You would think that at this moment, because the interest rate is rising, people would slow down their spending. That’s partly true. But many people built up their savings during the early days of the pandemic, and they’re still drawing on that savings to make purchases today.

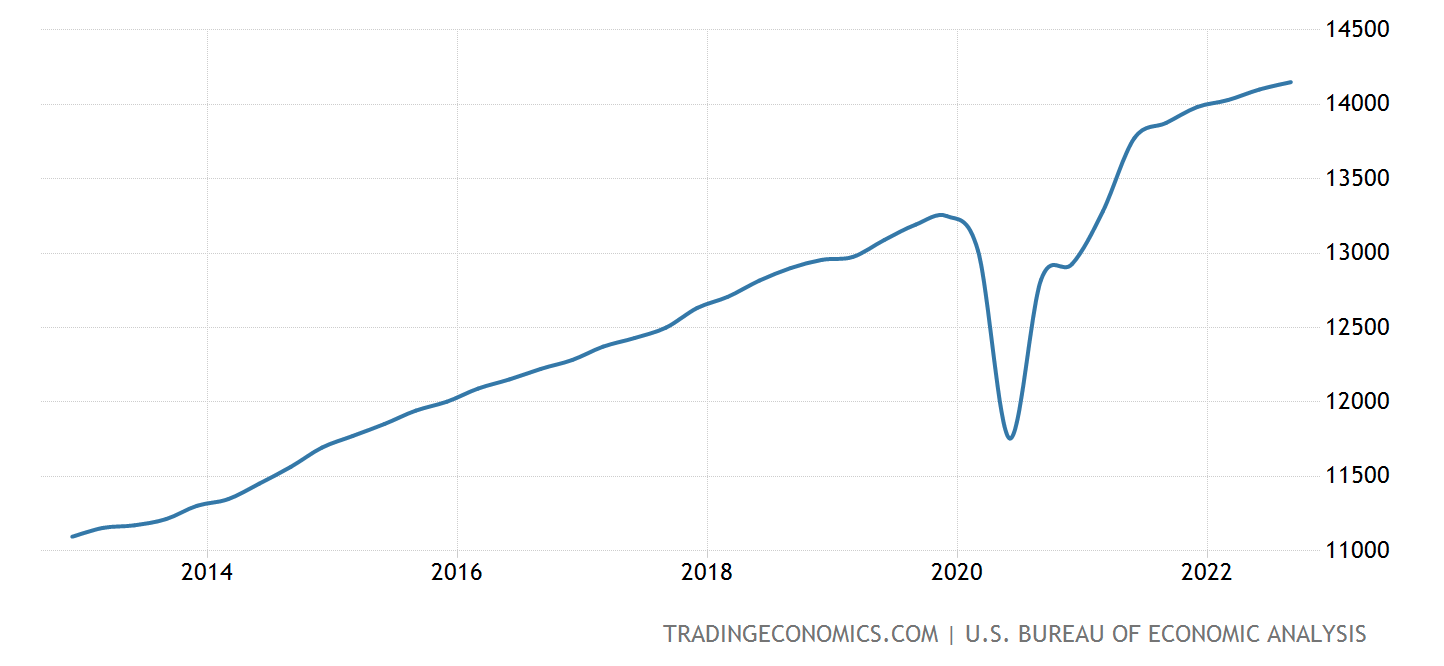

Here’s what economists see. Take a look at the chart of consumer spending below.

See that massive dip in 2020 and into 2021? That’s savings. The consumer spending chart is almost the inverse of the personal savings rate, which you can see below.

Notice that the personal savings rate has dipped down below the 10-year average at the same time that consumer spending is maintaining its historical average. That tells us the average consumer is now spending a portion of what they would typically save.

Saving your spending

A dollar not saved is a dollar spent. But how consumers spend their money is an important indicator of the health of our economy. Are people spending at malls or online? On cars or computers? With credit cards or cash? Are they going into debt to fund the purchases or are they still solvent? A lot of these consumer decisions depend on their expectations about the economy. Will credit be available in the future? Will they hold on to their jobs?

Credit card debt is back to pre-pandemic levels, as a recent article from The Wall Street Journal points out, meaning most people are resuming their “normal” spending patterns. Although missed payments remain below pre-pandemic levels, “rising card balances could be an early sign of financial pain.”

“The rising cost of food, gasoline and housing,” the Journal noted, “has strained household budgets, forcing some Americans to use their credit cards to make ends meet. The trillions of dollars in rainy-day funds Americans built up during the pandemic are dwindling.”

Following the money

It matters where we spend. Economists use two companies as proxies or estimates of the health of both consumers and the economy as a whole: Amazon and Walmart, top choices for consumers since they’re the largest stores in the world. Amazon employs about 1.5 million people and has an annual revenue of almost $470 billion, while Walmart employs over two million people with revenues of over $570 billion.

How are they doing? Well, Amazon is set to lay off thousands of corporate workers. But this may be part of a larger slowdown in tech — Amazon is still a tech company after all. Walmart, on the other hand, grew earnings 8.2 percent over the last year, mainly due to rising prices. Rising prices help boost profits but have also helped bring in a new clientele seeking Walmart’s “everyday low prices.” Store visits increased 2 percent.

However, according to the Journal, “Walmart executives said Tuesday that they remain cautious on the health of the U.S. consumer over the next year in the face of high food and gas prices.”

All things considered, the coming weeks, but today especially, will be important indicators for how we’re doing. While children will soon be waiting for Santa to come down the chimney, economists will be waking up early to watch for earnings reports, hopefully with the same holiday cheer.