When markets decline, entrepreneurs often rise. Businesses lay off employees as a recession kicks in, and a number of those go on to start their own businesses. In 2020, as the pandemic shut down many types of work, workers started a record 4.4 million new businesses, according to the U.S. Census Bureau. In 2021, entrepreneurs broke that record and started 5.4 million.

Remember this when things turn sour. Because last week, the head of the Federal Reserve, Jerome Powell, told Congress that his policies may lead us toward a recession.

Whether entrepreneurship necessarily thrives overall during market downturns is difficult to know for sure. A report from the Cleveland Fed following the Great Recession, published in 2011, argued that overall entrepreneurial activity declined in the downturn’s wake. Others, like a 2021 paper from the Kauffman Foundation, a nonprofit focused on entrepreneurship, found that startup job creation is uncorrelated with economic downturns.

The segments of small businesses

As with any statistical analysis, it’s all about how you slice it. A short 2009 paper from the Richmond Fed offers a more detailed glimpse into the emergence of small businesses at that time. The author, David van den Berg, notes that recessions may reduce the supply of credit, which we’ve learned is crucial for economic activity. But they increase the supply of something else: labor.

If you’re looking into founders’ motivations for entrepreneurship, you can generally sort new businesses into two segments: opportunity and necessity. Some new businesses are started by seeing a market opportunity. Others are started because the founders’ sources of income declined or ended and they need a place to take their labor — this is “necessity entrepreneurship.”

Van den Berg points out that Clif Bar, Microsoft, Burger King, Hyatt, and many more companies all started during recessionary periods. Necessity entrepreneurs, especially those starting low- and moderate-income potential businesses, drove most of the increase in new business ventures during the 2007 to 2008 years.

The same seems to be the case after COVID-19.

Post-pandemic entrepreneurship

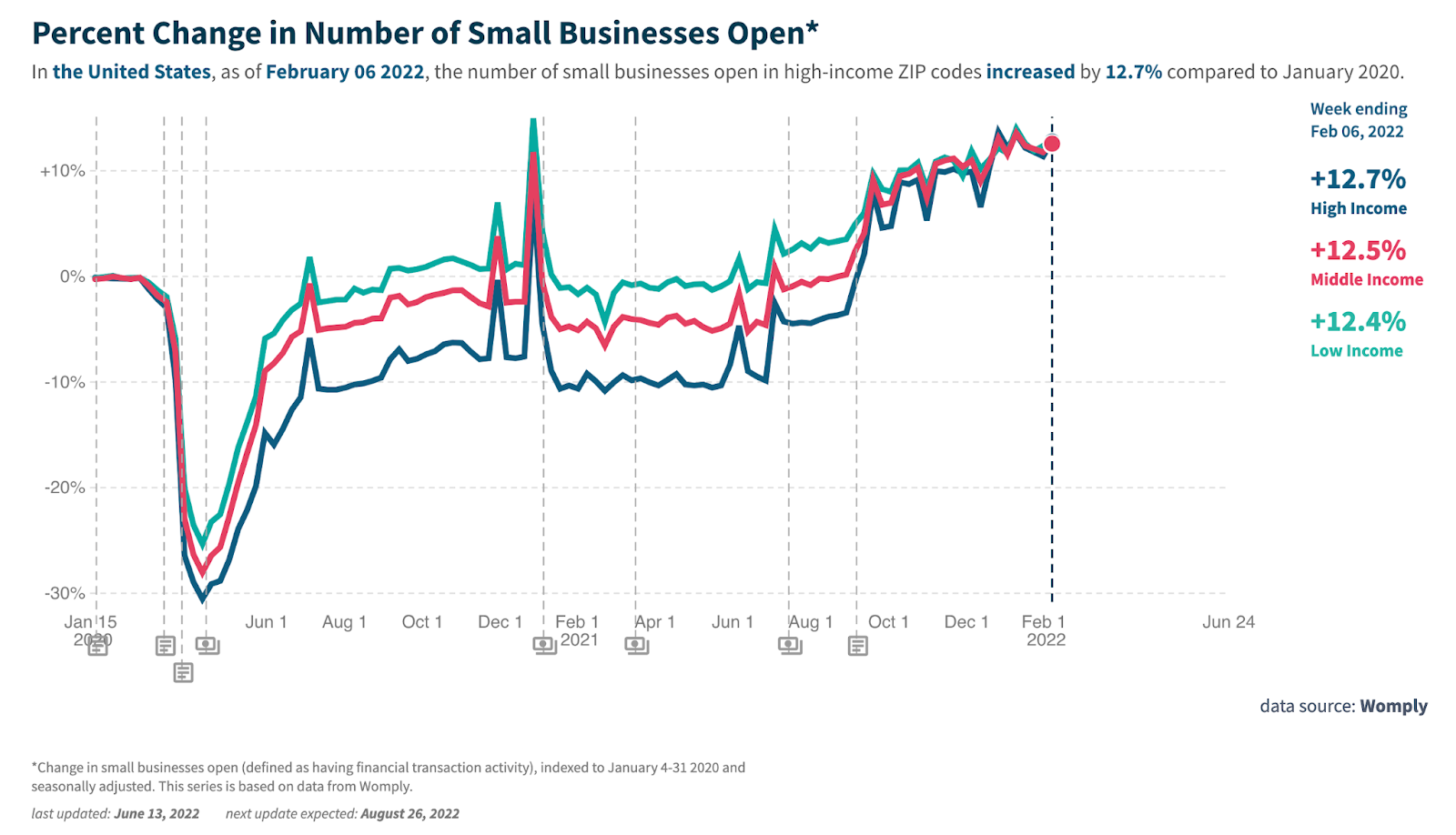

A think tank associated with Harvard economists called Opportunity Insights uses real-time data, public and private, to track economic activity since the beginning of the pandemic. They created a dashboard to track metrics for consumer spending, small business job postings, employment, education, and public health, among others.

Their data shows that low-income ZIP codes bounced back through entrepreneurship at a much faster rate than high-income areas. In the depths of the recession in early April 2020, low-income areas opened small businesses by a rate of over five percentage points more compared to high-income areas. One year later, the difference was over nine percentage points. High-income ZIP codes have since taken the lead, but not by much.

So why have low-income areas led the charge here? This data shows that, as far as economic activity is concerned, recessions force low- and middle-income workers to get creative when they need to replace their income. They might not have the savings or the job security to cushion a downturn, so they make their own by innovation.

Conversely, Americans have more cash now than at any time before, especially those in the lowest income brackets, much due to economic relief packages and decreased expenses during the pandemic’s shutdown. But perhaps this provides the security that entrepreneurs need to get their businesses started if the economy turns south in the near future.

Further, technology available now can cut down the cost of starting and running a business. Two companies come to mind. The first is Square, a company known for those little white card readers connected to smartphones. Square does much more than that, of course, including invoicing, banking, customer support, and even e-commerce websites. The second is Squarespace, somewhat of a competitor to Square. This company allows entrepreneurs to build sophisticated websites, email marketing, invoicing, and more.

The tech is one reason why younger, and more tech-savvy, folks feel more compelled to start businesses than older generations. Squarespace found in one survey that “the vast majority (92 percent) of Gen Zers would start their own business, compared to 86 percent of Millennials, 74 percent of Gen X, and 50 percent of Baby Boomers.”

Entrepreneurs help your community thrive

It’s important to track this slice of the American economy — and those comprising it within your community — because, as the Richmond Fed paper points out, “Small businesses create most of the nation’s new jobs, employ about half of the nation’s private-sector workforce, and provide half of the nation’s nonfarm, private real gross domestic product, as well as a significant share of innovations.”

The word “entrepreneur” derives from the concept of undertaking a project, especially a risky one. As uncertainty mounts over the coming months, your risk takers will need your support, wisdom, and your prayer to get the future going.